Why Martech Needs Simplicity, Not More Labels

-

The martech landscape now has over 15,000 tools, making vendor selection increasingly overwhelming.

-

“Digital Experience Platform” emerged from CMS evolution but has not replaced CMS in buyer search behavior.

-

CMS remains 20–50 times more searched than DXP, showing persistent buyer familiarity with older terms.

-

Proliferation of terms like “composable DXP” and “DXC” adds confusion before core needs are addressed.

-

Clear, consistent terminology helps buyers make faster, more confident decisions in a complex market.

The martech landscape is famously vast and constantly growing. As of 2025, there are 15,384 marketing technology tools competing for attention today, spanning everything from content management to personalization engines, analytics suites, automation platforms, AI assistants, and beyond. Each year, new vendors emerge, incumbents acquire or pivot, and entire categories shift under the influence of technology trends, market hype, and analyst framing.

It’s already a challenging environment for people who choose, buy, and run these tools. Recent research confirms this burden, with two-thirds of marketing technology decision-makers reporting they use 16 or more martech solutions, creating overwhelming operational complexity.

Given all that, the last thing buyers and users need is more terminological sprawl—yet that’s exactly what the industry keeps producing. Nowhere is this clearer than in the rise of the “Digital Experience Platform” label.

How We Got Here: From CMS to DXP

If you rewind the clock just 10 years, most organizations looking to manage digital content were searching for a Content Management System (CMS). CMS was—and still is—the anchor term in most procurement processes.

Analyst firms like Forrester and Gartner began noticing that leading CMS platforms were expanding beyond their original remit. To capture this expanded vision, the analysts needed a broader category name. Forrester appears to have established the earliest public record with their Digital Experience Platform Waves, with the earliest documented reports I could find dating back to at least 2015. Gartner entered the conversation and cemented the term’s prominence when they retired their Web Content Management Magic Quadrant in June 2020, explicitly citing a shift in client demand toward the wider scope of DXP.

Today, Gartner defines a DXP as “an integrated set of core technologies that support the composition, management, delivery, and optimization of contextualized digital experiences.”

The Reality: Buyers Still Search for “CMS”

Despite these carefully crafted definitions, conversations with martech platform sellers reveal that many RFPs still lead with CMS terminology. Buyers often frame their needs in CMS language because that’s the concept anchored in their governance and workflows.

This buyer behavior is confirmed by search data showing that “CMS” consistently generates 20-50 times more search interest than “DXP” over the past five years, with CMS interest actually trending upward while DXP remains barely measurable.

While some digitally mature organizations do issue RFPs specifically for a “DXP,” these tend to be cases where the scope clearly includes multiple components beyond web content management.

The Proliferation of New Terms

Once the DXP label was in circulation, the lexicon splintered further:

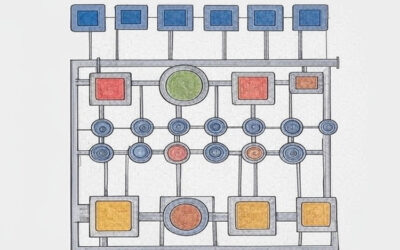

- Composable DXP – A DXP assembled from modular, API-driven components

- Digital Experience Composition (DXC) – The orchestration layer that assembles multiple services

- Packaged Business Capabilities (PBCs) – Individual functional building blocks

- Headless DXP – A headless CMS-driven DXP where presentation and content are decoupled

Many concepts reflect genuine shifts in architecture. Gartner research indicates that by 2026, at least 70% of organizations will be mandated to acquire composable DXP technology, compared to 50% in 2023. But for the average buyer, these terms layer on extra complexity before the basics are addressed.

The Problem: Complexity on Top of Complexity

The martech ecosystem is inherently complex because the number of tools is vast, product overlap is common, integration is a constant challenge, and business needs vary widely.

The number of tools is vast – Choosing among 15,400+ tools is overwhelming, with the landscape showing 10,156% growth since 2011.

Integration is a constant challenge – Research shows that integration challenges top the list of martech difficulties for B2B enterprise CMOs.

Adding new, loosely defined category labels makes this harder, not easier. It risks inflating scope and can lead to overbuying and under-utilization. Recent survey data confirms this concern, with 54.9% of marketing technology decision-makers reporting disappointment in martech payoff, despite continued investment.

Why Simplicity Matters

From a buyer’s perspective, clarity in language directly supports better decision-making. From an industry perspective, using consistent and simplified language helps ensure that innovations are evaluated on their functional merit, not just their label.

Less Jargon, More Clarity

The story of “DXP” is a case study in how analyst-driven terminology can shape—and sometimes distort—martech conversation. Yet most buyers still write CMS-driven RFPs, and the proliferation of adjacent labels risks obscuring core needs.

In a landscape of 15,400+ tools, the challenge isn’t a lack of categories—it’s an overabundance. If we want to make martech purchasing more effective, we need to simplify. Use labels to clarify, not mystify. The ultimate goal isn’t to win the jargon game—it’s to help buyers make better, faster, and more confident decisions in an already complex world.

New Knowledge

Composable Thinking Powers Composable DXP Success

Explore how marketing and technology leaders use composable thinking to restructure teams, empower decision-making, and outpace competitors—even with similar technology. (Reading time: 7 mins)

AI Capabilities That Transform Marketing Teams

You’ll see why top marketing teams treat AI as a strategic partner, not a magic box, and how to align tools with business goals. (Reading time: 8 min)

Martech Optimization: Best Practices for Success

If you’re optimizing your martech stack without understanding how it drives customer value, you’re wasting budget and breaking systems. Learn how clarity fuels real growth. (Reading time: 6 min)

Generative AI Transforms Marketing Teams and Strategy

AI reshapes marketing by blending automation with creativity. This article shows CMOs how to integrate AI, tackle team resistance, and build a future-ready mix of specialists and generalists. Learn to redefine roles, foster innovation, and scale impact. [Reading time: 6 min]